Which Of The Following Best Describes The Materials The Company Uses To Make Its Footwear

Activity-Based, Variable, and Assimilation Costing

34 Depict and Identify Toll Drivers

As you've learned, the near mutual bases for predetermined overhead are direct labor hours, direct labor dollars, or car hours. Each of these costs is considered a cost driver because of the causal relationship between the base and the related costs: As the cost driver'due south usage increases, the toll of overhead increases likewise. (Figure) shows various costs and potential cost drivers.

| Mutual Manufacturing Expenses and Potential Cost Drivers | |

|---|---|

| Common Expenses | Potential Toll Drivers |

|

|

The more accurately a company tin make up one's mind the cost drivers for its products, the more accurate the costing information will be, which in plow allows direction to make better apply of the cost data in making decisions. As technology changes, however, the mix between materials, labor, and overhead changes. Frequently, improved technology means less waste of material and fewer direct labor hours, merely maybe more overhead. For example, technology has changed the fashion pharmaceuticals are manufactured. Advancing technology allows for the now smaller labor force to exist more than productive than a larger labor force from earlier years. While the labor cost has changed, this subtract may only be temporary as a labor force with higher costs and unlike skills is oftentimes needed. Additionally, an increase in engineering ofttimes raises overhead costs. How accurate, then, is the company's production cost information if it has become more efficient in its production process? Should the company notwithstanding exist using a predetermined overhead application charge per unit based on direct labor hours or car hours? A detailed analysis of the cost drivers will answer these questions.

Some other do good of looking at price drivers is that doing so allows a company to analyze all costs. A visitor can differentiate amidst costs that drive overhead and have value, those that do non drive overhead merely all the same add value, and those that may or may non bulldoze the overhead but practice not add any value. For example, a furniture manufacturer produces and sells wooden tables in various colors. The painting process involves a white base of operations coat, a color glaze, and a clear protective top coat. The iii coats are practical in a sealed room using a spraying procedure followed past an ultraviolet drying process. The depreciation on the spraying machines and the ultraviolet bulbs used in the painting process are overhead costs. These costs drive or increase overhead, and they add value to the product past increasing the quality. Costs associated with repainting or fixing any blemishes are overhead costs that are necessary to sell the product just would not exist considered value-added costs. The goal is to eliminate as many of the non-value-added costs as possible and subsequently reduce overhead costs.

Cost Drivers and Overhead

In today's production environment, there are many activities within the product procedure that can contribute to the cost of the product, but determining the price drivers may exist complicated because some of those activities may modify over time. Additionally, the advisable level of assigning cost drivers needs to be determined. In some cases, overhead costs such as inspection increase with each unit inspected, and the costs need to be allocated on a per-unit level. In other cases, the overhead costs, such as machine setup costs, are incurred each time a batch of products is manufactured and need to be allocated at the batch level.

For example, the labor hours for the staff taking, fulfilling, and inspecting orders may increase as the number of orders increases, driving upwards the overhead. Furthermore, the costs of taking orders or of quality inspections can vary per product and may not be captured properly. Technology improvements, including switching to automated processes for product, may decrease the labor hours of the production staff, driving the labor-related overhead downward but potentially increasing other overhead expenses. These activities—lodge taking, fulfillment, and quality inspections—are potential price drivers associated with production, and they each drive the overhead at varying rates.

Identifying Cost Drivers

Cost drivers vary widely amidst companies.

- After costs are accumulated into price pools, what information would help management select the appropriate cost commuter?

- Name an appropriate cost driver for each of the following cost pools:

- Constitute cleaning and maintenance

- Mill supervision

- Car maintenance

- Motorcar setups

Place Cost Drivers

How does a company determine its cost drivers for indirect materials, indirect labor, and other overhead costs? To begin the determination of appropriate cost drivers, an accountant analyzes the activities in the product production process that contribute to the price of that production. An action is any action that consumes visitor resources, such equally taking orders for a product, setting up machines to produce the product, inspecting the product, and providing client support before and through the social club process. For case, Musicality'southward straight costs can be traced to the products, but there are indirect costs associated with using various types of fabric for each product. While the Orchestra product has more intricate materials and labor, it has fewer costs associated with requisitioning and carrying materials to the production line than the other products take. Additionally, examining the inspection costs indicates the Orchestra product is a simple production to inspect, and then random quality inspections are sufficient. But individual inspections for both the Solo and Band products are critical, and the overhead related to inspection costs should be based on the number of inspections.

Equally yous can imagine, the unique aspects of the product process for each product affect the overhead cost of each product. However, these costs may not exist allocated to the products accordingly when overhead is applied using a predetermined charge per unit based on one activeness. While Solo, Band, and Orchestra might appear to be unlike just in quality, they are actually very unlike from each other when it comes to manufacturing overhead costs.

Whether the products produced crave significantly different overhead resources or non, the company benefits from understanding what its cost drivers are. The more efficiently each product'south activities are tracked, the more actual cost drivers are discovered, and the more accurately overhead tin can be assigned to each product.

Toll Drivers for Pocket-size Businesses

The value of analyzing cost drivers can be used in budgeting beyond allocating overhead to products. American Express has forums designed to help small businesses be successful. Knowing the toll drivers for your business organization can help with budgeting. American Limited states that all business activities are related to v main toll drivers:1

- Employee head count is often the driver for function supply expense.

- Salesperson head count is oftentimes the driver for auto and other employee travel expense.

- The number of leads required to reach the target sales goal is often the commuter for advertising, public relations, social media, search engine optimization expense, and other expenses associated with generating leads.

- Sales and all related variable expenses are often the driver for commissions, bad debt, insurance expense, then on.

- Stock-still costs, such as postage, web hosting fees, business licenses, and cyberbanking fees, are often overlooked as cost drivers.

Key Concepts and Summary

- Overhead costs are analyzed and grouped based on similar activeness bases. A cost commuter, such as inspections, machine setups, or society taking, is selected for each cost grouping.

- Analysis of cost drivers allows for better selection of true overhead cost drivers and more appropriate allocation of overhead.

(Figure)Which is not a step in analyzing the cost driver for manufacturing overhead?

- identify the cost

- place not-value-added costs

- analyze the effect on manufacturing overhead

- identify the correlation betwixt the potential driver and manufacturing overhead

(Effigy)Overhead costs are assigned to each product based on ________.

- the proportion of that product's use of the cost driver

- a predetermined overhead charge per unit for a single price commuter

- cost of the product

- machine hours per production

(Figure)(Figure)When is an activity-based costing arrangement better than a traditional resource allotment organization?

(Effigy)What is the reward of labeling activities as value added or nonvalue added?

Non-value-added costs can often be eliminated since they are rarely essential, and identifying them helps managers reduce their costs.

(Figure)What conditions are necessary to designate an activity as a cost driver?

(Figure)For each cost puddle, identify an appropriate cost driver.

- order department

- accounts receivable processing

- catering

- raw cloth inventory

Answers may vary merely should be similar to the post-obit: A. number of orders; B. number of customers; C. number of meals; D. number of textile requisitions received.

(Effigy)Identify advisable cost drivers for these cost pools:

- setup cost pools

- assembly cost pool

- supervising cost pool

- testing cost puddle

(Figure)Match the activity with the most appropriate cost commuter.

| Activities and Cost Drivers | |

|---|---|

| Activity | Toll Driver |

| Fringe benefits | Square feet |

| Electricity | Directly labor hours |

| Depreciation | Machine hours |

| Motorcar maintenance | |

| Rut and air workout | |

(Figure)Identify advisable price drivers for these cost pools:

- material cost pool

- machine cost pool

- painting cost pool

- maintenance cost pool

(Figure)Match the activity with the most appropriate price driver.

| Activities and Price Drivers | |

|---|---|

| Activeness | Cost Commuter |

| Mill maintenance | Number of setups |

| Payroll taxation | Number of employees |

| Hire | Foursquare feet |

| Machine setups | Direct labor hours |

| Factory supervision | |

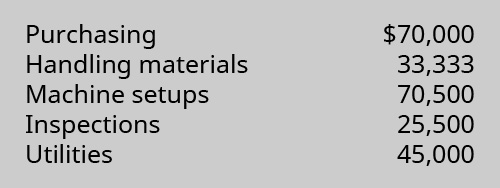

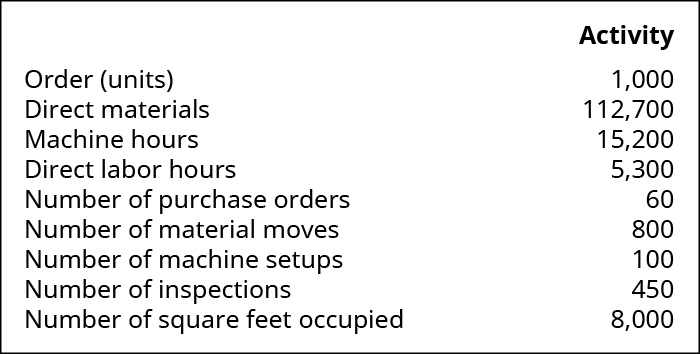

(Effigy)A local picnic table manufacturer has budgeted these overhead costs:

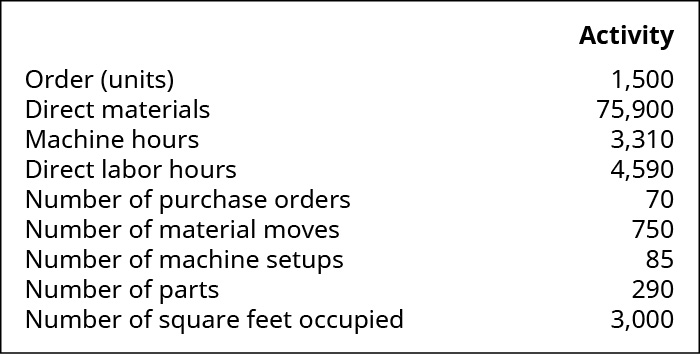

They are considering adapting ABC costing and accept estimated the price drivers for each puddle as shown:

Recent success has yielded an order for one,000 tables. Assume direct labor costs per hour of $xx. Determine how much the task would price given the post-obit activities:

(Figure)Explicate how each activity in this listing tin can be associated with the corresponding unit of measurement or batch level provided.

- Assembling products: unit level

- Issuing raw materials: batch level

- Car setup: batch level

- Inspection: unit level

- Loading the labeling motorcar: batch level

- Equipment maintenance: batch level

- Printing a imprint: unit level

- Moving material: batch level

- Ordering a part: batch level

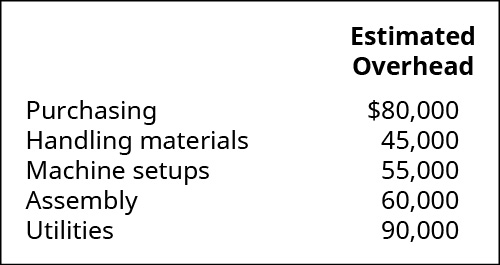

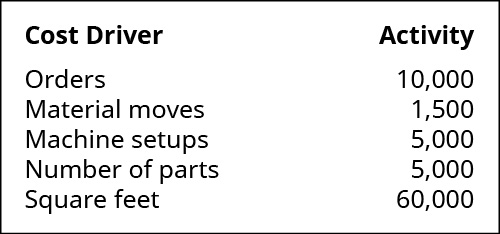

(Figure)A local picnic table manufacturer has budgeted the post-obit overhead costs:

They are considering adapting ABC costing and have estimated the cost drivers for each pool equally shown:

Recent success has yielded an order for ane,500 tables. Determine how much the job would cost given the following activities, and bold an hourly rate for straight labor of $25 per hour:

(Figure)Explain how each activity in this list tin can exist associated with the corresponding unit or batch level provided.

- Assembling products: batch level

- Issuing raw materials: unit of measurement level

- Machine setup: unit level

- Inspection: batch level

- Loading the labeling machine: unit level

- Equipment maintenance: unit level

- Printing a imprint: batch level

- Moving material: unit level

- Ordering a part: unit level

(Effigy)College Cases sells cases for electronic devices such equally phones, computers, and tablets. These cases have college logos or mascots on them and can be customized by adding such things as the client's proper noun, initials, sport, or fraternity letters. The company buys the cases in various colors and then uses light amplification by stimulated emission of radiation technology to practise the customization of the letters and to add school names, logos, mascots, and then on. What are potential activeness-based costing pools for College Cases, and what would be appropriate cost drivers?

Footnotes

- 1 American Express. "5 Cost Drivers to Help You Brand Accurate Expense Projections." June 23, 2011. https://world wide web.americanexpress.com/the states/modest-business/openforum/articles/5-cost-drivers-to-aid-you-brand-authentic-expense-projections/

Glossary

- cost driver

- activity that is the reason for the increase or subtract of another cost; examples include labor hours incurred, labor costs paid, amounts of materials used in product, units produced, or any other activity that has a cause-and-effect human relationship with incurred costs

Which Of The Following Best Describes The Materials The Company Uses To Make Its Footwear,

Source: https://opentextbc.ca/principlesofaccountingv2openstax/chapter/describe-and-identify-cost-drivers/

Posted by: kingrepasustem.blogspot.com

0 Response to "Which Of The Following Best Describes The Materials The Company Uses To Make Its Footwear"

Post a Comment